Retail and leisure: reinventing the wheel

We’re now into the third week of non-essential retailers opening their doors to the public. According to figures from Springboard, footfall at UK retail destinations soared by 155.2 per cent week-on-week, while footfall rose 202.4 per cent in central London on reopening day, compared to the same day in 2019.

However, once the initial and inevitable influx of customers stores eases, it’s important to examine what the short and long-term future will look like for some of the hardest hit sectors of the Covid-19 pandemic.

The current landscape: a state of limbo

Despite millions of pounds in support provided by the government, there is a clear lack of realism from those in the retail and leisure sectors, with many left in a state of limbo. As we approach the summer season and second half of the year, we must examine the factors that will determine either the rise or fall of the UK high street.

Commenting on the current situation, Brian Burke, director at Quantuma, said: “As we come out of lockdown, retailers will face a number of challenges. Despite millions in support, many are facing uncertainty in relation to revenues, built up costs and debt, and will be required to make further investments to keep up with changing consumer behaviour and working practices. This means that retailers will have to make tough decisions and assess all of the fundamentals of their business, including the make-up of their property portfolio, what they need to do to harness online channels, and consider how these align with their expectations going forward.”

James Pow retail advisor at Quantuma, adds: “Many retailers have continued to assume that the retail sector will return to near normal activity, which is incredibly harmful. This hasn’t been helped by the Government by extending the generous loans and furlough activity, which will no doubt lead to a crash from September onwards when the reality of UK retail footprint shrinkage manifests in its entirety.

“As well as this, retailers fear that the current problems in Europe may lead to a tThird lLockdown in the UK if border controls are not sufficiently in place.”

A local, experiential affair…

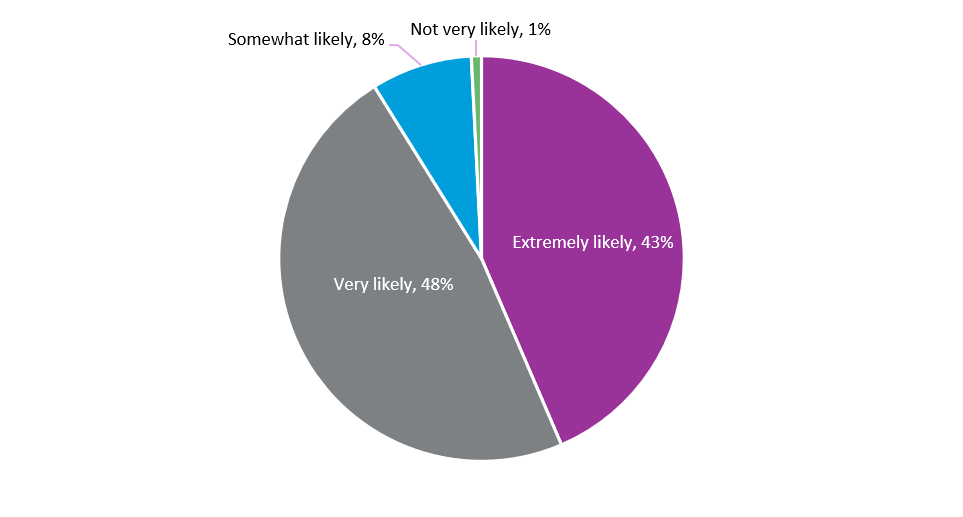

After several lockdowns which have forced consumers to stay close to home, they have come to realise the importance of supporting local businesses. This has meant that loyalty and spending post-pandemic will likely remain concentrated in their local towns and villages. Results from one of our latest webinar polls echo this sentiment, with 46 per cent of respondents agreeing that shoppers are extremely or very likely to stay and buy local, as opposed to traveling to retail destinations, such as large shopping centres and districts.

In the cities and towns that were once teeming with office workers and consumers, larger retailers will have to reassess their store strategies and be very selective about which stores remain open, and which ones will be closed. Of the ones that remain open, an experiential retail offering where consumers can come into a store to touch, smell or taste products on offer will be crucial. Selfridges is one example of a retailer that has done incredibly well with their experiential offering. Those that have multi-brand and channel strategies will be the ones that come out stronger and more resilient post-pandemic.

“Brands that can offer added value and yet still co-exist with other similar value brands, will be a winning formula going forward,” said Pow. “The oversupply of “u2 lookalikes” is finished. Many retailers are rushing to rejuvenate their footprints with selection of younger, edgier brands in their mix or a rush to concession of their previously own-label square footage that lived off other brand’s adjacency in their stores with lower prices. However, these are short-lived considerations.

“Real change will come from a move back to residential and other uses. This will happen much faster in rural townships which have showed more demise than most with their proliferation of charity shops, barbers and beauty salons flitting from one rent-free location to another. Local rural individuality with wonderful direct-to-home consumer service will accelerate this model and lead to weekly farmer and craft markets reappearing on tree-lined high streets with forward-thinking councils.”

An uncertain future

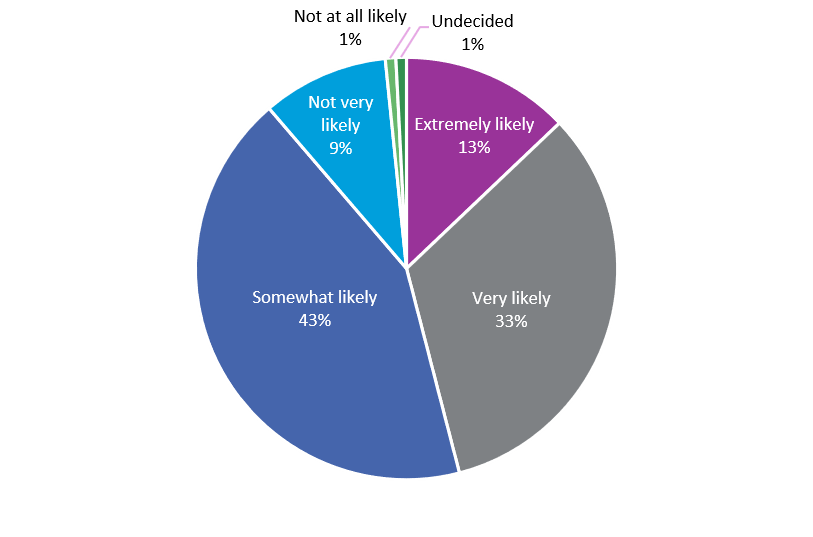

The coming months will continue to be very tricky for retailers to navigate, especially as they come head-to-head with prominent online-only retailers, such as Boohoo.com, Asos, and Amazon. When we asked the attendees of our latest retail sector webinar, a resounding 91 per cent agreed that consumers will continue to shop at these retailers, rather than physical, bricks and mortar stores.

The Government has provided support packages to this point and that will not last indefinitely, so retailers need to plan ahead and think smart if they are going to survive. Multi-channel strategies will be crucial, whereby business capitalise on the stores that remain while keeping up their online channels to meet consumer demands.

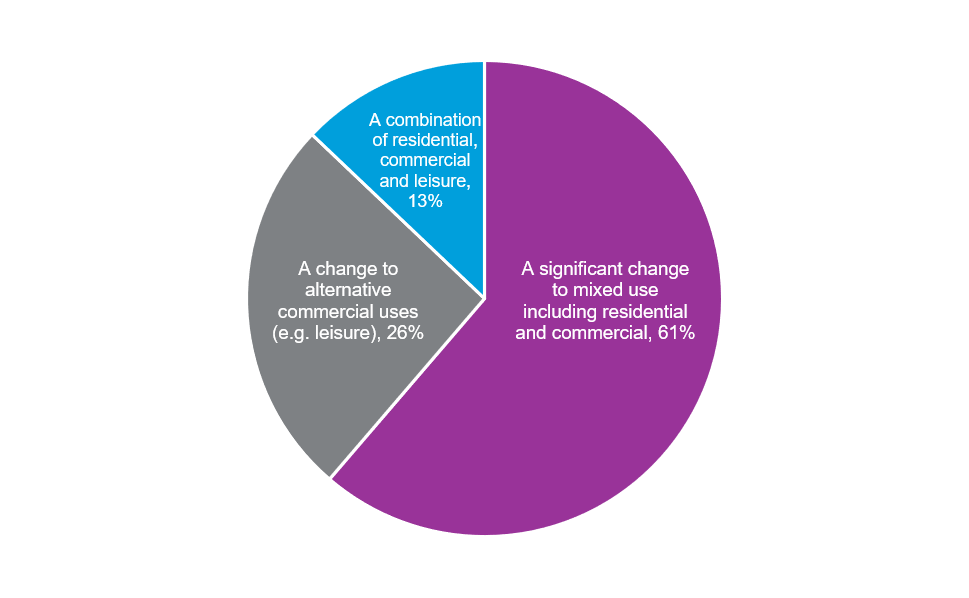

For many high streets across the UK, looking at ways to repurpose and evolve retail estates will be crucial over the coming five years. Our webinar poll respondents agreed, with 61 per cent seeing a significant change to mixed use of retail estates, including residential and commercial. This means that we will likely see a curation of stores come together – from offices and designers, to smaller brands, bigger brands, events – to create multi-purpose spaces.

Restrictions are lifting and shops are opening up, which will mean that confidence will start to creep up. However, a level of uncertainty and concerns remain about when we will finally be able to say retail is truly open for business.

Retail sector poll

At our latest retail sector webinar, we asked 124 attendees three questions to gauge their thoughts on the future of the sector as we slowly come out of lockdown. The results are below.

Q1. How likely do you think shoppers are to stay and buy local as opposed to travelling to retail destinations i.e. retail parks?

Q2. It is predicted the high street is set to evolve post pandemic with retail units and real estate repurposing over time. Over the next 5 years which of the following do you think is most likely?

Q3. In the future, how likely do you think consumers are to continue to shop online (Amazon, Asos, Boohoo and other prominent online retailers) rather than at physical bricks and mortar stores?